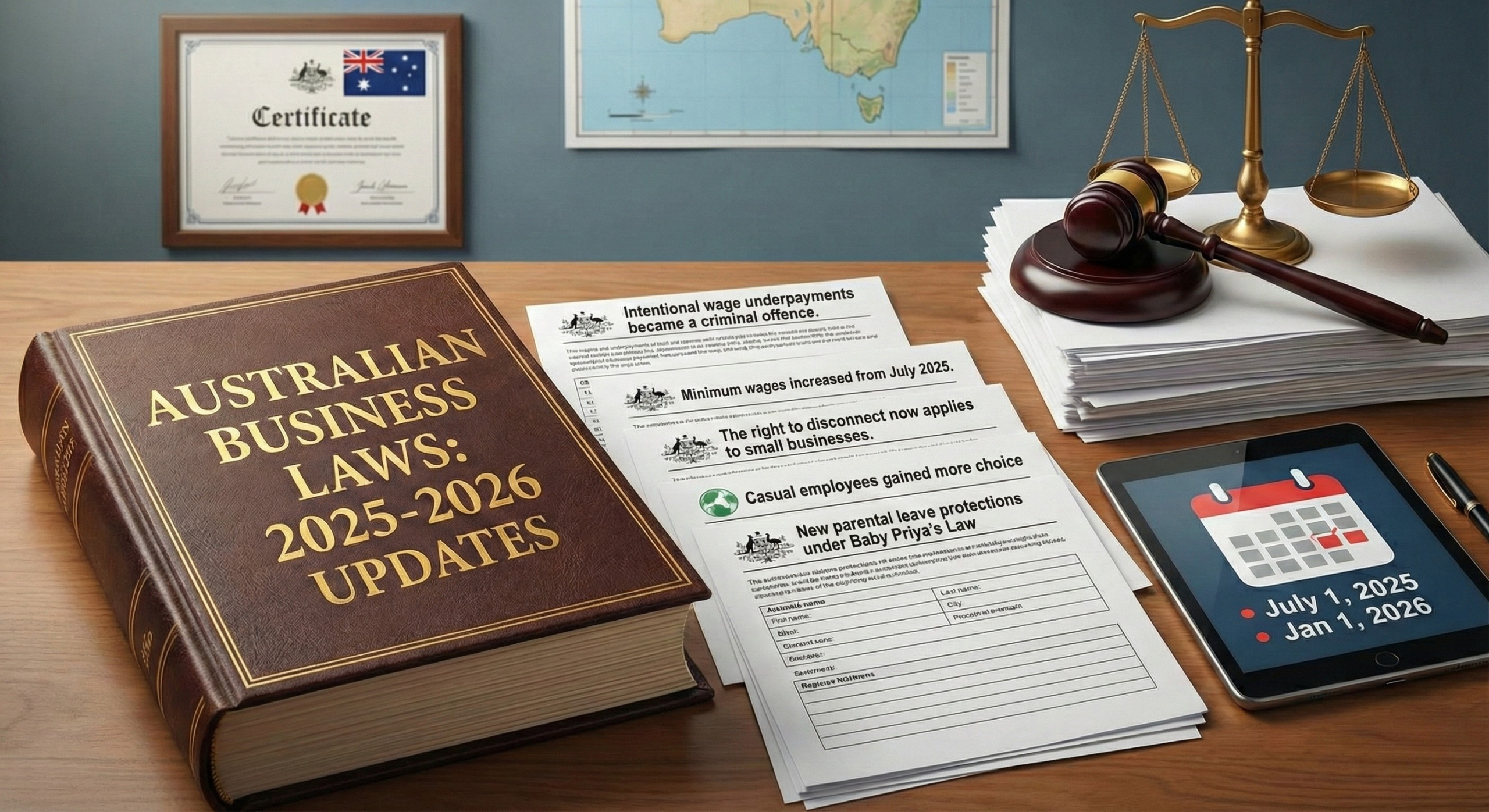

2025 was a big year for workplace law changes, and many of them directly affect how you pay, manage and communicate with your employees. If you run a small or medium-sized business, staying across these updates is essential to managing risk and running your business with confidence.

Below is a practical summary of the key workplace law changes introduced in 2025, and what they mean for your business heading into 2026.

From 1 January 2025, intentionally underpaying employees became a criminal offence under federal law.

This marked a major shift in how serious underpayment breaches are treated. While honest mistakes are not criminalised, deliberate conduct is now subject to criminal investigation and prosecution.

What this means for you:

The 2024–2025 Annual Wage Review increased minimum wages by 3.5%, effective from 1 July 2025.

If you employ award-covered staff, your payroll should already reflect these updated rates. Salaries that were close to award minimums may now need reviewing to avoid underpayment issues.

From 26 August 2025, the right to disconnect started applying to small businesses.

Informal expectations around after-hours availability can now create disputes. Clear communication and realistic boundaries are more important than ever.

From 26 August 2025, casual employees of small businesses became eligible to request conversion to permanent employment through the employee choice pathway.

Eligible casual employees can notify you in writing that they wish to become full-time or part-time. Workforce planning and budgeting should take potential conversions into account.

From 7 November 2025, Baby Priya’s Law introduced new protections for employer-funded paid parental leave in cases of stillbirth or the death of a child.

This law dictates that employer-funded paid parental leave generally can’t be cancelled in these circumstances, and employees are now entitled to greater certainty and support during an extremely difficult time. This means parental leave policies may need updating.

With so many changes taking effect in a single year, now is a good time to step back and review how your business is set up.

We recommend you:

Workplace laws continue to evolve, and penalties for getting it wrong are higher than ever. Keeping informed and proactive is the best way to protect your business and support your people.

For ongoing updates, the Fair Work Ombudsman website maintains a comprehensive and regularly updated list of workplace law changes.

After a long break, coming back to work in January can make the pressure points stand out. It’s easier to identify the patterns: decisions that take too long, jobs that create constant interruptions, and weeks that fill up without moving the business forward.

A genuine reset is not about doing more. It is about clearing what is getting in the way, tightening your choices, and setting up the year to run with less strain.

Here are seven realistic ways to reset your business for the year ahead.

A major change to Australia’s superannuation system is coming, and it will directly affect how small and medium-sized enterprises (SMEs) manage payroll.

From 1 July 2026, employers will be required to pay their employees’ superannuation guarantee (SG) at the same time as salary and wages. This reform, known as Payday Super, is designed to reduce unpaid super, improve transparency and strengthen employees’ retirement savings.

A new year brings a clean slate, but also familiar pressures for small business owners. When you are busy running a business, it is easy to move from one task to the next without stopping to plan. The beginning of the year is one of the few opportunities to step back, reassess and set the tone for what follows.

Rather than reacting to issues as they arise, a considered approach now can reduce pressure and create momentum that carries through the year.

Tailored Accounts © All rights reserved.