Everyone remembers how the collapse of Lehman Brothers helped to trigger the 2008 Global Financial Crisis. With the recent demise of Silicon Valley Bank and Credit Suisse, people around the world are wondering if we are on the edge of another financial crisis.

Let’s break it down.

What happened with Silicon Valley Bank?

On 10th March 2023, Silicon Valley Bank (SVB) failed after a bank run, marking the second-largest bank failure in United States history and the largest since the 2008 financial crisis. It was one of three March 2023 United States bank failures.

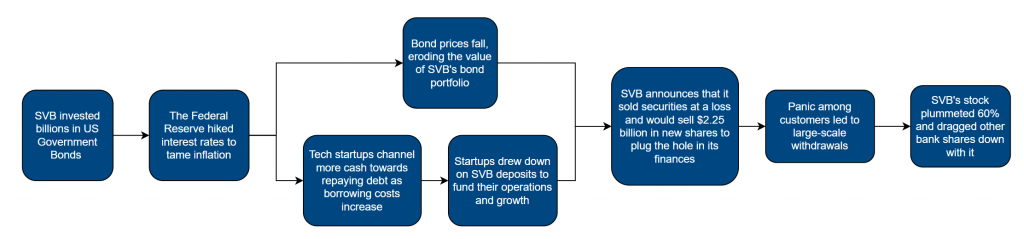

The following flowchart outlines how this occurred.

What happened with Credit Suisse?

Credit Suisse is a “global systemically important bank,” a bank whose risk profile is deemed to be of such importance that its failure could trigger a wider financial crisis. Overnight on Wednesday, Credit Suisse shares crashed by as much as 30%.

There were a couple of reasons behind the drop:

But, it’s unlikely Credit Suisse will collapse. The bank was provided with a 50 billion Swiss francs ($81 billion) lifeline from the Swiss National Bank. Additionally, UBS agreed to buy Credit Suisse in a 3 billion Swiss francs ($4.5 billion) takeover.

Should we be worried about Australian Banks?

Short answer: Not Really.

Silicon Valley Bank’s demise came from having too many long-term US Treasury bonds that plunged in value as interest rates rose, and having to sell them at significant losses. While no Australian bank could withstand a bank run, a repeat of the SVB collapse in Australia is virtually impossible. The structure of the balance sheets of Australian banks and the regulatory incentives put in place by APRA to encourage the matching of assets and liabilities prevent Australian banks from falling into the same trap.

Credit Suisse’s current troubles are the result of longstanding financial weaknesses. While external factors such as the current economic situation and prior collapses of banks may have contributed to its downfall, years of financial mismanagement are the main cause.

Treasurer Jim Chalmers says initial advice from regulators is that any fallout for Australia’s broader financial system is unlikely to be significant.

"Australians should be reassured that our institutions are solid, our banking sector is well-capitalised, and we're in a better position than most other nations to deal with the challenges we face in the global economy."

Treasurer Jim Chalmers

It’s a view shared by Professor Fariborz Moshirian, a global financial stability expert from the University of New South Wales.

"At this stage there is no need for any concern about the Australian banking system and its resilience [...] The Australian banks are well-capitalised, have access to liquidity and have strong balance sheets."

Professor Fariborz Moshirian

But we should still be cautious

Just last month, NAB made a sobering assessment of the Australian economy. NAB is expecting economic growth to slow to 0.7% over 2023 and 0.9% in 2024. With some quarters forecast at just 0.1% growth, Australia risks a recession. That relies though on the Reserve Bank easing monetary policy, or cutting interest rates, early next year.

However, Commonwealth Bank predicts that Economic growth will continue to slow throughout 2023 under the impact of rising interest rates but Australia should avoid a recession. CBA’s economists are expecting that interest rates will have to be cut by the RBA in the fourth quarter of this calendar year (October 1 – December 31) to help avoid the prospect of a recession.

While a recession is far from set in stone, both NAB and Commonwealth Bank agree that Australia is teetering on the edge. The RBA’s decision in the coming months will set the course for Australia’s future.

Source: Tailored Accounts

Working to buy your own home is a rite of passage in Australia, but these days, navigating the housing market can be a massive headache. Learn about the grants & concessions available to make this process easier.

The ATO has updated the process for claiming work-from-home (WFH) tax deductions, with these changes being backdated to 1 July 2022. Accurate records of hours worked from home are now mandatory for those looking to use the revised fixed rate method.

In this hyper-stimulated world, it’s no surprise that people struggle to focus. A recent survey found that over 60% of employees can rarely, if ever, complete an hour of deep work without being disrupted. So where is all that time – and money – going?

Tailored Accounts © All rights reserved.